Malta rakes in €200m every year by refunding 85% of tax paid on foreign dividends (around €1.5 billion annually)

Malta has refunded over €13 billion in income tax to corporate shareholders in the last 14 years under its refundable tax credit system

Malta has refunded over €13 billion in income tax to corporate shareholders in the last 14 years under its refundable tax credit system.

The data was published in the House of Representatives in a response to a PQ from Nationalist MP Bernice Bonello, who requested the number of foreign companies which pay just 5% after a six-sevenths refund on their full 35% tax rate on income.

Malta has no specific corporate rate for businesses, which get taxed at the highest 35% rate on income. But dividends that are remitted to foreign subsidiary companies or shareholders from companies tax-registered in Malta, can benefit from a substantial six-sevenths refund on the tax paid.

Ultimately this results in a 5% tax on dividends received from Malta, which are then possible liable to further income tax in the country of receipt.

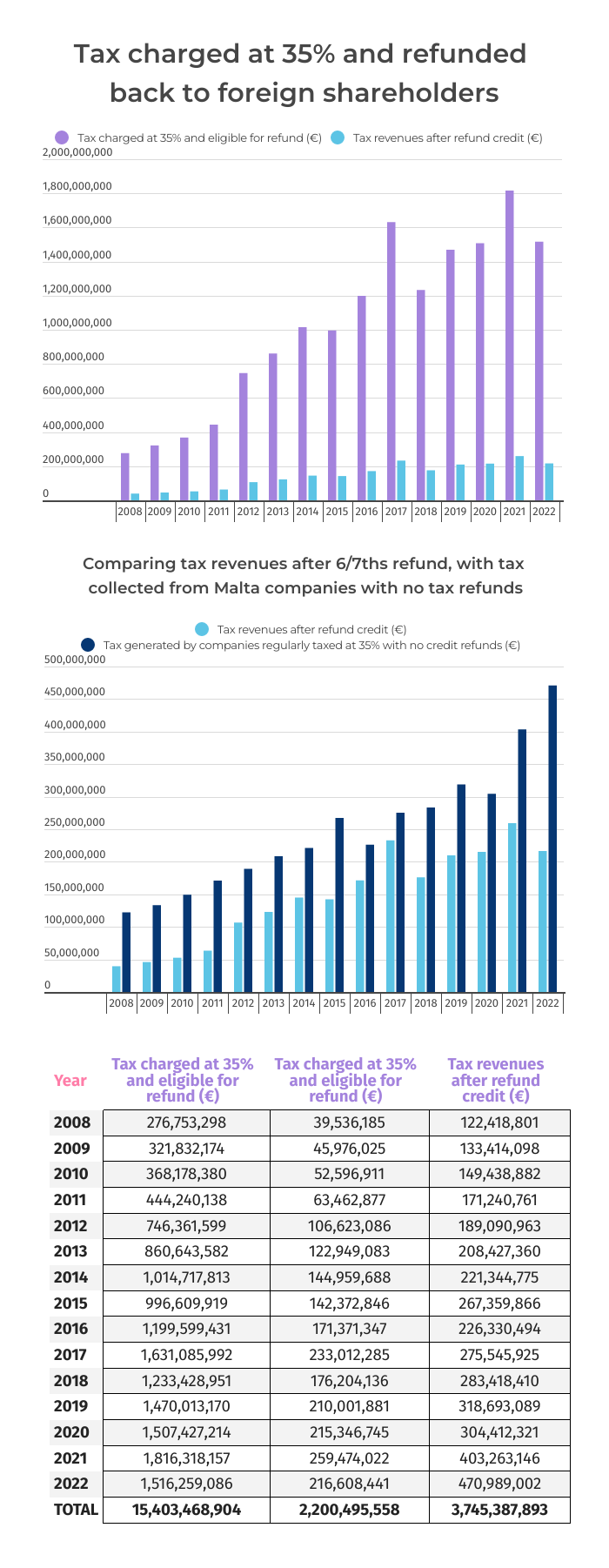

Every year since 2008, Malta has refunded an average of 14.2% from the tax owing from these eligible companies.

Currently there are 8,012 companies actively registering for tax refunds under the refundable tax credit system.

The number of companies benefiting from the refund has grown exponentially since 2008, when over €276 million in tax owing was whittled down to €39 million; to 2022, when a sheer €1.5 billion was whittled down to €216 million after refunds.

The highest volume of taxation ever registered was in the pandemic year of 2021, with €1.8 billion, of which the taxman retained some €260 million.

In total between 2008 and 2022, the tax owing by these companies registered in Malta was of €15.4 billion, with €13.2 billion refunded and leaving a total of €2.2 billion in the Maltese coffers.

To put this amount in perspective, Malta’s annual government budget alone costs over €5 billion.

But with over 43,000 tax-registered companies in total, direct taxation on income accounts for over €470 million in government revenues. The additional €260 million in 5%-taxable companies is a welcome boon to national resources.

Malta’s financial services lobby has defended the tax refund system, arguing that large multinationals that set up tax-registered companies in Malta are a source of business and jobs, as well as of resultant tax revenues from business conducted outside of Malta.

A fundamental pillar of Malta’s tax system, shareholders in receipt of dividends are entitled to a tax credit equal to the tax borne on the profits out of which the dividends are paid. Since the tax rate of 35% applicable to companies is also the highest tax rate in Malta, shareholders do not suffer any additional tax on the receipt of dividends. Shareholders therefore get a refund if they include their dividend in their tax return.

Critics of the system believe the tax leakage punishes those countries in which these businesses conduct their trade. The refund system has long angered other EU countries, who feel it unfairly drains taxes that should have been paid in the home country, where the real economic activity takes place, rather than in Malta.

In 2023, finance minister Clyde Caruana said Malta would not be immediately introducing a new minimum tax rate for companies as agreed in the OECD. EU countries can delay the introduction of the new 15% minimum tax by up to six years. The rules apply to companies that have a global income of more than €750 million.

This would impact around 660 multinational companies that have a base in Malta, which however employ some 20,000 people.